Legacy Newsletter 2021

Stories of Legacy Giving

Many individuals and families have entrusted the Community Foundation for Monterey (CFMC) to carry out their charitable wishes. The latest issue of our annual “Leaving a Legacy” newsletter introduces donors Jean Duff, and Leslie Mulford, two donors who came to the CFMC for their own specific reasons and have found several different ways the CFMC’s array of giving options helped maximize giving through their estate (Jean) and IRA (Leslie).

We also introduce Andrea Scott, our Director of Gift Planning and new Legacy members.

We also introduce Andrea Scott, our Director of Gift Planning and new Legacy members.

Jean Duff

Jean Duff first came to the CFMC in 2014 to establish the Jean and Jim Duff Fund, an endowed donor advised fund, in honor of her late husband. Jean enjoys receiving the menu of grantmaking opportunities sent to CFMC fund holders, and has made gifts in the fields of Children and Youth Development, Health and Human Services, Community Development, Arts, Culture and Historic Preservation and Environment and Animal Welfare. Jean, named Philanthropist of the Year in 2016 by the Association of Fundraising Professionals, Monterey Bay, truly exemplifies the spirit of giving.

I enjoy learning about different giving options. My giving has grown to new areas of interest and it’s wonderful to see the impact.” – Jean Duff

Now, seven years later, her trust and partnership with the CFMC has grown with the addition of other ways of giving. To expand her giving, she revisited her estate plan and established a Charitable Gift Annuity (CGA), an instrument that provides income for life (a portion of which is tax-free). The remainder creates an endowed fund to benefit any nonprofit or cause she chooses. She named a dear friend as beneficiary of the income. Upon her death, the remainder will go to her donor advised fund.

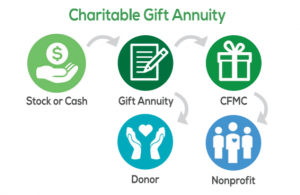

Charitable Gift Annuity

A Charitable Gift Annuity allows you to make a generous gift to benefit the nonprofit(s) of your choice, and receive income for life. You or a named beneficiary can start receiving annuity payments immediately or choose to defer them.

A Charitable Gift Annuity allows you to make a generous gift to benefit the nonprofit(s) of your choice, and receive income for life. You or a named beneficiary can start receiving annuity payments immediately or choose to defer them.

How It Works

- You establish a CGA naming a beneficiary agency (or agencies), a field of interest or unrestricted fund, such as the Fund for Monterey County.

- You can give cash, appreciated stocks, real estate, or other assets.

- You (or other beneficiaries) receive a fixed stream of income for life and an immediate tax deduction for the charitable portion of your gift.

- Upon your death, the remainder is added to an existing endowment or used to establish a new endowed fund to benefit the nonprofit or cause of your choice.

- Your fund will generate grants, leaving a charitable legacy by helping to do good work forever.

This is an ideal giving option for those who have an asset that they want to use for good, and receive guaranteed income. For information or to see rates of return, call 831.375.9712 or visit www.cfmco.org/CGA.

Giving to Areas of Interest – Leslie Mulford

Leslie Mulford worked with the CFMC to support fields of interest through an IRA Qualified Charitable Distribution.

I knew I wanted to create a fund in my name and specify the things I wanted

to support,” she said.

Leslie chose to create the Leslie Mulford Fund to benefit her areas of interest. Grants from the fund now supports at risk youth, elderly services, music in schools, literacy and disaster relief. By directing part of her IRA to the Community Foundation, she was not taxed on the withdrawal, and maintained the tax benefit of lower taxable income overall. Read her story.

Leave a Legacy

How will you express your values, experiences and interests to the next generation? Through a planned gift, you can be assured your charitable assets will be directed to the causes you care about most. If you have made the important decision to include the CFMC in your estate plans, you can become a Legacy Society member. Legacy Society members trust the CFMC to ensure their wishes are carried out.

The annual Legacy Society Luncheon honors those who have chosen to partner with the CFMC through their estate.

How it works

- You include the CFMC as a beneficiary of your will or trust. We can help you or your attorney with sample bequest language.

- You determine the type of fund you would like to establish with your gift and the nonprofit(s) you wish to support.

- Your charitable gift is excluded from your assets for estate tax purposes.

Your gift creates a source of community capital, helping to do good work forever.

Ways to Leave a Legacy

- Bequest (through your will or trust)

- Charitable Remainder Trust (CRT)

- Charitable Gift Annuity (CGA)

- Gift of Life Insurance

- Designate the CFMC as beneficiary of a Retirement Plan or IRA

- Create an Endowed Fund (or contribute $25,000 or more to an endowed fund)

If you have included the CFMC in your estate, please contact us so we may acknowledge your generosity. While we recognize those who have notified us of their plans, Legacy Society members may also choose to remain anonymous. We will work with you and your professional advisor to create the best solution for you and lasting benefit for others.

Please give Christine Dawson or Andrea Scott a call at 831.375.9712 or visit cfmco.org/PlannedGiving to learn more. We would be honored to assist you in your legacy planning.